jersey city property tax rates

1 be equal and uniform 2 be based on current market worth 3 have a single estimated value and 4 be considered taxable in the absence of being specially. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

A Breakdown Of 2022 Property Tax By State

Property tax rates in New Jersey vary significantly.

. Ad Public Jersey City Property Records Can Reveal Mortgages Taxes Liens and Much More. Jersey City NJ 07306 City of Jersey City Contact Info. Jersey Citys average tax rate is 167 of assessed home valuesslightly lower than the New Jersey state average of 189.

201 795 6200 Phone 201 714 4825 Fax Get directions to the county offices For more details about taxes in City of Jersey City or. View Property Appraisals Deeds Structural Details for Any Address in Jersey City. Based on this rate and average market.

City of Jersey City. New Jersey Property Taxes Go To Different State 657900 Avg. Somerset County Property Taxes.

North Plainfield has the highest property tax rate in Somerset County with a. Not in New Jersey. Hudson County collects on average 167 of a propertys.

The state average for the countys share of property tax is 19 and thus Jersey City would be above the state average for county tax too. So our tax bills in Q3 are using. Under the resolution the estimated tax rate will increase from 1604 percent to 1889 percent which will lead to an increased levy from 6356 million to 7738 million.

Online Inquiry Payment. Below is a town by town list of NJ Property tax rates in Somerset County. The General Tax Rate is used to calculate the tax assessed on a property.

Under Tax Records Search select Hudson County and Jersey City. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. The median property tax in Hudson County New Jersey is 6426 per year for a home worth the median value of 383900.

TO VIEW PROPERTY TAX ASSESSMENTS. 252 551721 252 05 252 51 252. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a.

Jersey Citys 2021 school tax rate was 052 and Jersey City sent 37 of their property tax dollars to the schools. Left click on Records Search. The office of the City Assessor shall be charged with the duty of assessing real property for the purpose of general taxation.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. Ad Public Jersey City Property Records Can Reveal Mortgages Taxes Liens and Much More. The remaining 63 of the property.

The average effective property tax rate in New Jersey is 242 compared to the national average of 107. It is equal to 10 per 1000 of the propertys taxable value. Taxation of real property must.

Jersey City Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent informed about your. View Property Appraisals Deeds Structural Details for Any Address in Jersey City. NEW -- New Jersey Map of Median.

Compute your tax expense for last year vs this year. Compute the tax rate each year for both the schools and city - this is 1 2 levy tax base. As an introductory frame.

The average effective property tax rate in New Jersey is 240 which is significantly. Multiply each times your.

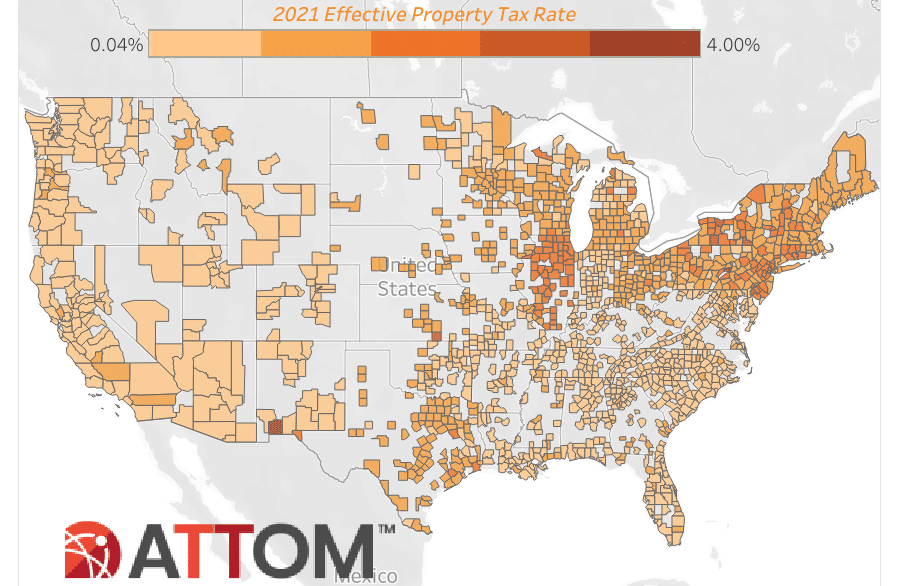

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Pursuing A Property Tax Appeal In New Jersey Sharlin Law Factory Architecture Metal Buildings Warehouse Design

Pin By Leventozgul1970 On Business Econ Commercial Map America History Geography

Riverside County Ca Property Tax Calculator Smartasset

State Local Property Tax Collections Per Capita Tax Foundation

Property Tax How To Calculate Local Considerations

Should You Renovate Before You Sell Your House Selling Your House Renovations House

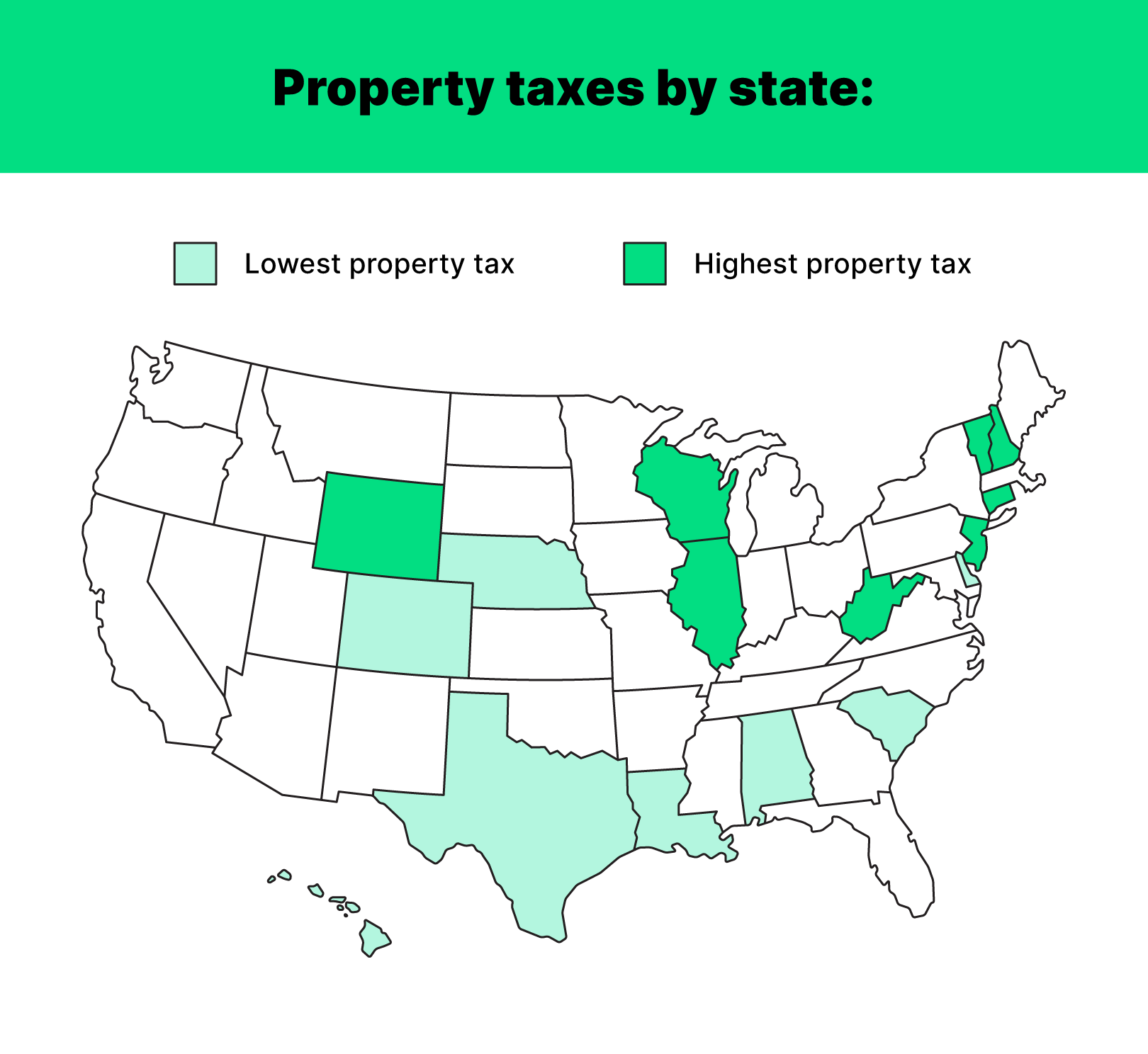

States With The Highest And Lowest Property Taxes Property Tax Tax States

State Corporate Income Tax Rates And Brackets Tax Foundation

How Much Does The Average Household In Your County Pay In Property Taxes And How Does Your County Stack Up To The Re Property Tax Brookings Real Estate Trends

2022 Property Taxes By State Report Propertyshark

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

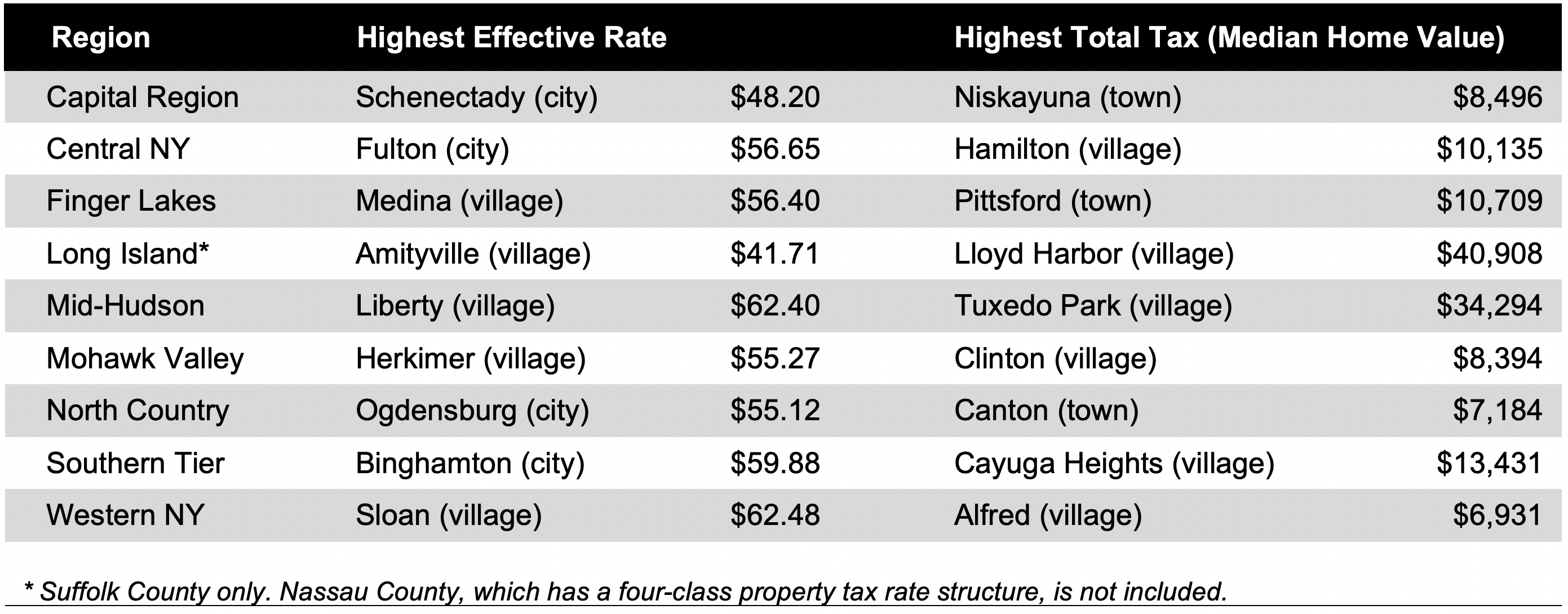

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

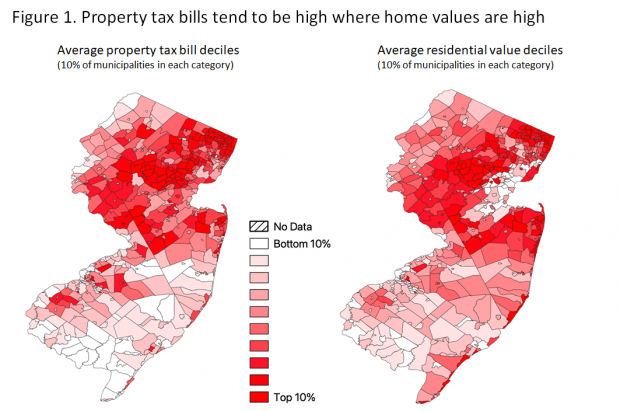

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Your Guide To Property Taxes Hippo

Thinking About Moving These States Have The Lowest Property Taxes

Property Taxes By State Embrace Higher Property Taxes

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Property Taxes By State County Lowest Property Taxes In The Us Mapped